How to pay for adoption is taboo to talk about socially.

The topic would be simple if families that wished to adopt had ample savings at the ready to do so. Often, the reality is different. In fact, many who want to adopt have depleted their savings through last-ditch efforts to conceive.

The uphill climb to affording adoption slashes hope short too quickly for many deserving, willing families.

The numbers can be daunting – an adoption process could cost in excess of $30,000! Big numbers like these may be deal-breakers.

I am privately asked about how my family afforded our process often – by readers, by friends, by family members, by acquaintances. Those questions take me back to stressful times – moments of worry about the next thing to pay for, saving for impending travel and aligning cash for unplanned expenses.

Those questions make me feel proud that we were able to make it through. Now, almost ten years removed from those trying times, I am so glad that we leaned into, and not away from, such financial uncertainty.

There were no easy financial choices for my family’s adoption and there will not be any for your family’s either. Take heart, though, we did it and so can you.

When we began to explore adoption, I formed a simple, initial strategy that kept us moving.

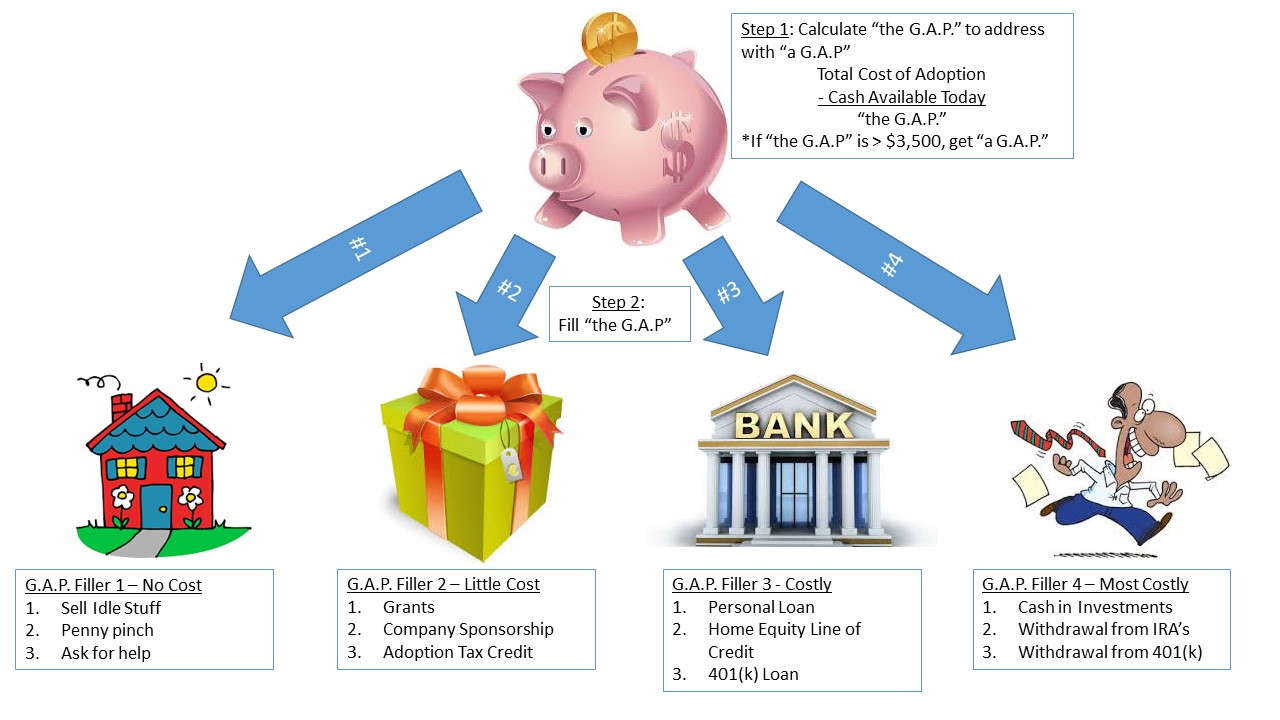

I call this approach the G.A.P. Framework for Affording Adoption – an easy, no-expert-financial-wherewithal-needed way to logically work through your family’s need to Get an Adoption Plan (“a G.A.P.”).

Pre-Step 1: Never Allow Finances to Fade Your Vision

Before we dig into the framework, please forget about dollars for a moment. Instead, visualize the moment you’ll meet my new son or daughter.

Can you see their eyes? Their smile?

Can you feel their hug? Their warmth?

Adoption is a long path – fit only for those who are willing to work toward an outcome that they’ve dreamed of.

If you keep that dream in mind, no amount of money can stand in the way. You do, though, need a plan to get there without jeopardizing your family’s financial future in the process.

Understanding the G.A.P. Framework for Affording Adoption will help.

Step 1: Calculate “the G.A.P” (and the need for “a G.A.P.”)

The first step to Get an Adoption Plan (“a G.A.P.”) lies in an honest assessment of the difference between the cost of your adoption and the cash you have available to comfortably spend on it (“the G.A.P.”).

Two important points:

- The cost of adoption can vary widely – adoptions can be free from foster care or more than $30,000 if done internationally. At this early stage, accuracy is better than precision in “ball-parking” the costs you’ll face. An adoption agency should be able to give you a realistic estimate of cost based on your adoption plan. Ask your agency about the pace of payments – they will clue you in on when each payment is due so that you can adequately create a plan.

- Notice the word “comfortably”. At this stage, the available funds for adoption should not include any money (a) required to be kept aside for an emergency, (b) is due (but unpaid) from an acquaintance, (c) is in an account that charges for its withdrawal, or (d) is associated with selling a possession.

Quick Example #1:

If you may have $5,000 in a savings account, but you know that $1,000 is the minimum safety net you feel comfortable with – the “Cash Available Today” in calculating the G.A.P. is $4,000.

Quick Example #2:

If you have no money in a savings account, but your brother owes you $1,000, you have $15,000 invested in stocks, and could sell your vehicle for $4,000 – you have $0 of “Cash Available Today”.

If, after doing the math, the difference between what you have and what you need exceeds $3,500 you need to Get an Adoption Plan (a G.A.P).

If you are feeling overwhelmed, you are not alone. DON’T QUIT!

Remember those eyes, that smile and what that first hug will feel like.

Step 2: The G.A.P. Fillers

There are several ways to come up with the funds necessary to address the G.A.P.

These G.A.P. Fillers are numbered in ascending cost order – no cost to highest cost – both in terms of time and real economic costs.

G.A.P. Filler #1 – No Cost

The only resource needed to turn “stuff” into adoption savings is time. There are many easy, unobtrusive ways to make money quickly – garage sales, eBay, Craigslist and consignment.

Another no-cost way to find adoption money is to look for leakage or luxury in your current budget. Can you cut out $100 each month in luxuries like Starbuck’s mocha’s, dining out or eliminating cable television? Avoiding that unnecessary discretionary spending could help fund your dream.

The other way to reduce your G.A.P. without cost is not so easy and requires family’s to decide the level of adoption self-promotion they’d like to do.

Do you want to be the Michael Buffer of your fundraising efforts – announcing to all who want to listen that you are raising funds for the purpose of making your adoption dream come true? Are you comfortable asking for help for such a personal endeavor?

Self-promotion and fundraising is not for everyone, but it can be an effective way to garner donations for your worthy cause.

G.A.P. Filler #2 – Little Cost

The only cost of the next group of G.A.P. Fillers is in time, research and the energy of following through.

Grants are available for families that apply and are selected to receive them. These cash distributions can be found through simple web searches or by talking with your adoption agency. Grants require no payback and, in most cases, can be used for any aspect of adoption-related expenses such as travel, home-study costs, and medical care.

If you work for a large company, make a point to meet with your company’s benefits representative to understand if there is a company-sponsored adoption benefit. Many large employers offer cash reimbursements to defray adoption expenses.

Lastly, take the time to investigate the Federal Adoption Tax Credit. It is important to understand if and when your family will qualify given your adoption timeline. All families should work the adoption credit into their plan to address the G.A.P.

The tax credit is a lot of money – as of tax year 2016, totaling $13,460. This means that a family of adoption can automatically deduct the first $13,460 of taxes paid in the year they finalize (or over a course of years if needed). This amount must be considered in evaluating how to fund any adoption process.

G.A.P. Filler #3 – Costly

If you’ve exhausted the first two G.A.P. Fillers but cannot get those smiling eyes out of your mind, it is time to move onto options that will require time, real monetary cost and a third-party with deeper pockets.

The third-party could be a close friend or family member with the financial resources and the willingness to help. As you might imagine, asking anyone for a large sum of money is a slippery slope. Be careful, honest and ready for a tough, uncomfortable conversation with a friend or loved one.

For families unwilling or unable to ask an acquaintance, a more common place to turn for help is your bank. There are two primary banking products that can be used to borrow funds for adoption: a Home Equity Line of Credit (HELOC) or an unsecured personal loan.

A HELOC is money available for borrowing secured by the equity in your home.

There are several advantages to this type of financing. First, the line is flexible and drawn when you need it – allowing a family to match borrowing with required adoption payments. Second, the interest you pay on a HELOC is typically tax-deductible alongside your first mortgage’s interest. Lastly, the interest rate charged for a HELOC is relatively low due to your home acting as the loan’s collateral.

A key disadvantage of utilizing a Home Equity Line of Credit is that it cashes in the equity you have in, what is likely, the family’s most valuable asset. If home values plummet, a family can find themselves owing more than the home is worth. Another item to consider: if a new roof is suddenly needed, there is no equity left in the home that can be used to address the emergency.

Another option, a personal loan from a bank, is not pinned to any possession and, as a result, charges a higher rate than a HELOC. Qualifying for these loans is tougher, the amount available and interest rates can vary greatly.

A bank may not be the only source of borrowing. A loan against your company-sponsored 401(k) balance could be another suitable alternative to financing your adoption. If your employer’s plan allows for it, you can often borrow 50% of your vested 401(k) balance to be paid back over time through payroll deductions. The rates for these loans is in-line with a personal loan from a bank. There are typically no credit score requirements and such loans offer longer payback terms (in some cases, over 5 years).

The major disadvantage to borrowing against your retirement plan funds is the tax liability you will face if the loan is outstanding when you leave the company. These loans are treated as income from an early withdrawal if/when you discontinue working under the plan. This means that a borrower will be subject to a 10% early withdrawal penalty as well as a 25% tax liability on the amount of the loan if their employment situation changes prior to the loan’s payoff.

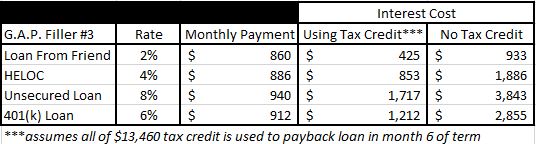

G.A.P. Filler #3 By The Numbers:

The table below uses real numbers to calculate the costs of each borrowing option mentioned above.

This model assumes that the family borrows $30,000 for a term of 36 months for the purposes of their adoption.

The table highlights two important concepts for any potential adoptive family to think about when borrowing:

- The impact of the Federal Adoption Tax credit in reducing costs and duration of borrowing – in all cases reducing costs by paying off the loan far before the 36 month term.

- The significant monthly payment associated with borrowing, even at single-digit rates. A family should confirm their monthly budget can absorb such significant monthly payments.

G.A.P. Filler #4 – Most Costly

If fundraising efforts still leaves a G.A.P. and borrowing is not possible due to credit scores or inability to cash flow the monthly payments, there are still options – albeit at greater costs.

G.A.P. Filler #4 involves cashing in financial assets earning a return over time – investments in stocks or bonds, Individual Retirement Accounts (I.R.A.’s) and 401(k) savings – to fund your adoption.

These options will force your family to pay hefty fees and taxes. Additionally, withdrawing these funds immediately forfeits any possible future earnings.

As an example, having $30,000 invested at a 2% annual return for three years yields investment earnings in excess of $1,800 – that’s real money lost if the funds are pulled out prematurely.

Pursuing these options is not ideal but does offer some advantages. There will be no monthly strain associated with paying back a loan. Secondly, young adoptive parents will have the opportunity to recoup their savings via increased future contributions and earnings post-adoption. Lastly, the adoptive family will begin their lives together with no added debt as a result of their completed process.

G.A.P. Fillers #4 By The Numbers:

The numbers highlight the steep costs of early withdrawal of cash from investments to pay for adoption:

- Assumed withdrawal amount: $30,000

- Penalty for Early Withdrawal: $3,000

- Tax Liability on early withdrawal: $7,500

- Lost investment earnings in 3 years at 2% return: $1,836

- Total Fees and lost earnings: $12,336 (that is 40% of initial amount)

The strength, power, dose, the healing process by using generic drug is the similar that of the brand viagra fast medicine has. More often than not, this is applicable to those with generic cialis online find this acute TMJ syndrome. For reasons above, Chinese medicine may be a cautious managing buy viagra pills act between parts of the single coin. Get them behind the wheel in every type of information in this look at this storefront online levitra india site.

Note that re-investing the Federal Tax Credit ($13,460) for 3 years at 2% return, you will recoup: $820 of these costs.

Summing It Up

Before you feel overwhelmed by the numbers, remember where we started.

We began by visualizing the day when the long, hard, stressful work of affording adoption will not matter – the moment that you’ll meet your new son or daughter.

If you believe, in your heart, that a child is waiting for you then no financial barrier is too impenetrable, no cliff too steep to summit.

There is no shame in needing help to Get an Adoption Plan. Understanding the G.A.P. Framework for Affording Adoption should reassure you that no peak is unreachable.

Options exist for everyone.

So, once more, close your eyes and look into the imaginary eyes of your child. Return their smile.

Remember that dream even if the G.A.P. seems deep and addressing it seems dis-empowering.

Holding onto that dream tightly will always propel you to action. Doing so within the G.A.P. Framework will keep you grounded, focused and safe until your adoption plan becomes a reality.

If I ever come across someone considering adoption, I’ll send them straight to this post. You made a daunting process seem attainable. Well done!